Mobile microloan conditions and where possible BEST 3 (KRW 500,000 to KRW 1 million) | Easy to use for unemployed microloans TOP 2 | Credit Recovery Commission microloan conditions | Let’s find out about the 24-hour mobile loan conditions. 신용회복위원회 소액대출

Mobile microloans can be made non-face-to-face 24 hours a day, 365 days a year, so they can be useful if urgent funds are needed.

In the case of mobile microloans, users of a certain credit rating or three telecommunications companies can use them regardless of their work or income.

BEST 3 and Conditions for Loans for Delinquent People | Late Review | Limit | Top 2 and Conditions for Short-Term Delinquent Loans | Grade 10 Delinquent Loans | Grade 8 Delinquent Loans

Mobile microloan terms and where possible

jasminevista.com

Mobile microloan terms and where possible

👇 Check out where mobile microloans are available!

Terms and conditions of mobile microloans and where possible BEST 3 (KRW 500,000 to KRW 1 million)

Kakao Bank emergency loan

Kakao Bank emergency payment loans can be borrowed regardless of job or income if you have a credit rating of 1 to 8 or if you can issue Seoul Guarantee Insurance insurance policies.

Loan conditions: Those between grades 1 to 8 of external credit rating (CB), who are 19 years of age or older and are eligible to issue Seoul Guarantee Insurance policy

Loan limit: 500,000 won to 3 million won

Loan term: 1 year

Repayment method: Temporary repayment of maturity

Interim repayment fee: None

Loan interest rate: 5.380% to 15.000% per annum

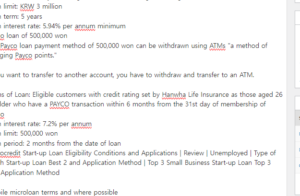

Finch emergency loan

Pinck emergency loans can be borrowed on the same day through the Pinck app and anyone over the age of 20 and within a credit rating of 8 can apply.

Loan conditions: 20 years of age or older, credit rating within 8 grades

Loan limit: KRW 3 million

Loan term: 5 years

Loan interest rate: 5.94% per annum minimum

Payco loan of 500,000 won

The Payco loan payment method of 500,000 won can be withdrawn using ATMs “a method of charging Payco points.”

If you want to transfer to another account, you have to withdraw and transfer to an ATM.

Terms of Loan: Eligible customers with credit rating set by Hanwha Life Insurance as those aged 26 or older who have a PAYCO transaction within 6 months from the 31st day of membership of Payco

Loan interest rate: 7.2% per annum

Loan limit: 500,000 won

Loan period: 2 months from the date of loan

Microcredit Start-up Loan Eligibility Conditions and Applications | Review | Unemployed | Type of Youth Start-up Loan Best 2 and Application Method | Top 3 Small Business Start-up Loan Top 3 and Application Method

Mobile microloan terms and where possible

Mobile microloan terms and where possible

👇 Check out the Kakao Bank mortgage!

Top 2 places where it is easy to borrow small amounts of unemployed people

NH Nonghyup Bank All-One Emergency Money Loan

It is a mobile emergency loan product that allows you to apply for a non-face-to-face loan on the day through the Nonghyup app, and if you use three telecommunication companies, you can borrow it regardless of income or job.

Loan conditions: Customers of three telecommunications companies, with a telecommunications grade of 9 or below, 19 years of age or older

Loan limit: KRW 3 million

Loan term: 3 years

Repayment method: Equal repayment of principal and interest

Interim repayment fee: None

Loan interest rate: 5.85% per annum minimum

Leadcorp Mobile Loan

Leadcorp mobile loans can be applied if you are 20 years of age or older, from office workers to unemployed people, and you can apply through mobile, so you can take out an emergency loan.

Loan conditions: 20 years of age or older to 60 years of age, contract workers, professional, public officials, soldiers, private businesses (self-employed), housewives, daily workers (labor workers), part-timers, and unemployed can all apply

Loan limit: Minimum KRW 1 million ~ maximum KRW 30 million

Loan interest rate: Within 20% per annum

Loan term: Up to 5 years

Where can I borrow short-term loans BEST 7 | Terms | Late | Interest | Limit | How to apply | Credit Card Short-Term Loan | Bank Short-Term Loan | Small Short-Term Loan Easy to Use

👇 Check out individual rehabilitation loans!

Credit Recovery Commission Small Loan Terms

The Credit Recovery Committee is a place that allows ordinary people to receive micro-financial support and debt adjustments from the government so that they can recover their credit.

The Credit Recovery Committee provides emergency livelihood loans to those who faithfully implemented the repayment plan.

The sincere patient loan system is a system that provides low-interest loans for emergency living funds to those who are faithfully repaying through the Credit Recovery Committee’s personal debt adjustment or the court’s individual rehabilitation system.

Subject to support

Anyone who has been faithfully repaying debt for more than six months after receiving debt adjustment from the Credit Recovery Committee or has completed repayment within the last three years

Anyone who has been faithfully repaid for more than 12 months after obtaining approval from the court for an individual rehabilitation reimbursement plan or has completed repayment within the last three years

A person who has separately designated as a person eligible for support according to the purpose of contribution by the financial support fund

Where can I get a car mortgage BEST 5 | Eligibility Conditions | Late | Interest | Limit | How to apply | Bank Car Loan | Credit Defector Car Loan | Unpaid Car Loan | Installment Car Mortgage | Used Car Mortgage

👇 Check out government youth loans!

24-hour mobile loan terms

Woori Bank’s emergency loan

Woori Bank’s emergency fund loans can be borrowed by customers within the 1-6 CB grade section for customers using three telecommunication companies, and can be borrowed on the same day through mobile non-face-to-face loans.

Loan conditions: Customers within the 1-6 level of CB for customers using the three telecommunication companies

Loan limit: Up to KRW 3 million

Loan term: 1 year

Repayment method: Temporary repayment of maturity

Interim repayment fee: None

Loan interest rate: Lowest annual rate of 7.07%

Mobile microloan terms and where possible BEST 3 (KRW 500,000 to KRW 1 million) | Easy to use for unemployed microloans TOPX | Credit Recovery Commission microloan terms | 24-hour mobile loan terms were discussed.

Mobile microloan terms and where are they available?

In the case of mobile microloans, users of a certain credit rating or three telecommunications companies can use them regardless of their work or income.

Please refer to the text for more information.

Where is it easy to get a small loan for the unemployed?

NH Nonghyup Bank’s All-One emergency fund loan is a mobile emergency fund loan product, and if you use three telecommunication companies, you can borrow it regardless of income or job.

Please refer to the text for more information.

What are the terms of the Credit Recovery Commission’s microloans?

The Credit Recovery Committee provides emergency livelihood loans to those who faithfully implemented the repayment plan.